Automating ESG reporting and assessing climate risk for an infrastructure fund

How infrastructure funds use VIDA to automate impact reporting and gain unprecedented transparency across their portfolio. Over 3,500 infrastructure funds globally invest in or develop infrastructure projects and only a few of them have offices in every region they have assets. Many of them have a genuine interest in sustainability and make it a part of their investment thesis. All of them need to report to their investors or regulators. For most of them ESG reporting is a mandatory process that will only increase in granularity and scope over the next 5 years.

| Product | Impact management |

| Country | Europe |

| Year | 2023 |

How do they track the impact of assets that are often far away?

Funds mostly rely on outdated data from on-ground teams, hire expensive consultants for on-site assessments, or worse have to spend time and money to check on the assets themselves to put them into reports that give neither them nor their LPs real comfort.

This is inefficient and costs a lot of money. It also leads to unintentional greenwashing and makes it difficult to identify potential economic and environmental risks to their assets.

Our users recently started using VIDA to set up their global infrastructure portfolios to manage the impact and efficiency of solar plants, wind parks, as well as mobility infrastructure and data centers.

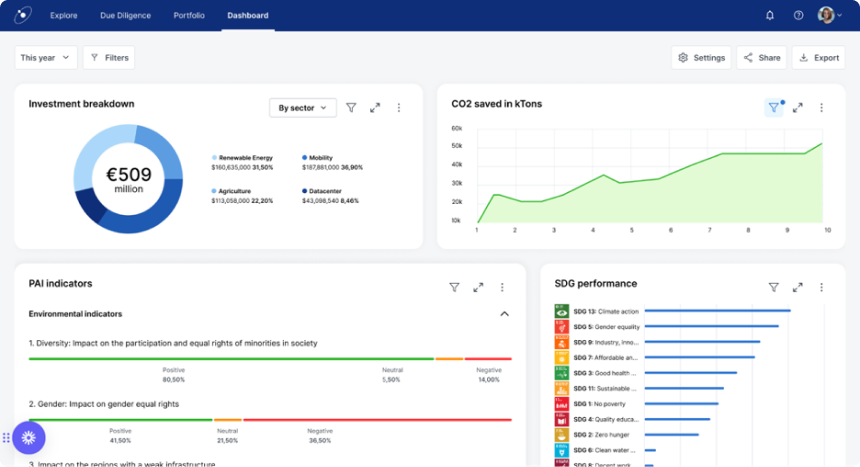

With VIDA, every fund can customize the views of its portfolio, include different internal and external data and set up automated reporting (e.g. SFDR). As a collaboration platform, VIDA makes communication with all project stakeholders easy. Users can create forms for on-ground teams to fill in, set up automated reminders and update information on assets regularly. Results are visualized at both the asset level and the overall portfolio level.

Once users set up and continually use VIDA, it became clear to them that VIDA is not only useful for monitoring but also for making better strategic decisions.

Renewable energy funds for example used VIDA’s data layers to strengthen their due diligence on new investments and to better assess the contact: climate and political risks, demographics and land-use, access to grid, and road network, etc.

Managing impact with VIDA is a great way to assess risks and improve long-term returns.

More stories

Ready tomanage your climate risk?