Mitigating physical climate risk of global infrastructure investments

Collaborating with a global infrastructure fund. A global infrastructure investment fund has integrated the VIDA platform into its operations to meticulously evaluate the physical climate risks associated with potential investments.

| Product | Settlement analysis, Catchment area analysis |

| Country | Ethiopia, Sudan, Kenya, Uganda, Nigeria, Niger, Senegal, Sierra Leone |

| Year | 2023 |

The firm’s CEO is particularly attuned to the escalating dangers posed by shifting climatic conditions, recognizing the impact these risks could have on their investment returns. Acknowledging the complexity of quantifying such risks internally, they’ve turned to VIDA as a credible solution.at was the challenge for our user. To meet it, VIDA was implemented as the operating system for impact management.

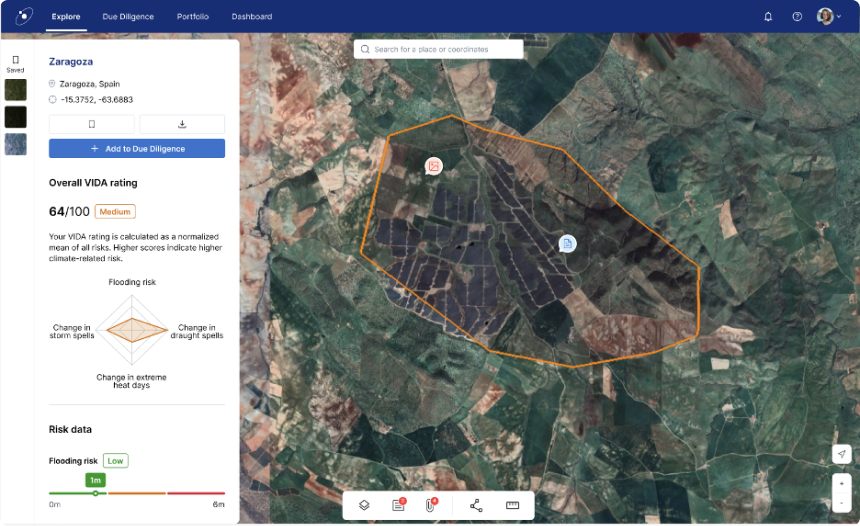

Embracing VIDA, the firm now conducts comprehensive climate risk assessments for each prospective site before committing to investments. Paramount among the risk factors are the vulnerabilities in physical infrastructure from climatic events such as flooding, intense heat stress, prolonged dry spells, and extreme precipitation episodes.

The firm’s investment analyst team used VIDA. They diligently scrutinize these climate risks for every potential investment opportunity. Those marked with minimal risk are advanced to the due diligence stage within the VIDA platform. At this stage, the firm initiates collaborative efforts by inviting several team members to contribute.

“Today, with respect to the SDGs, we are still flying blind. What doesn’t get measured doesn’t get done.” Dr. Tobias Engelmeier, CEO & Founder VIDA

In this collaborative space, the firm gathers more information. They invest in acquiring high-resolution, up-to-date satellite imagery and additional risk information to supplement their analyses. Furthermore, the firm includes data from external consultants, especially on-the-ground data, to create a complete risk profile of every potential investment. Once the comprehensive dataset is amassed, the firm is well-equipped to make informed decisions. Based on the collective evaluation, they reach a verdict on whether to green-light the sites for investment or to redirect their focus elsewhere. By leveraging VIDA’s capabilities, the firm efficiently navigates the intricate landscape of climate risks, ensuring that its investments align with its commitment to both sustainable returns and climate resilience.

More stories

Ready tomanage your climate risk?